retroactive capital gains tax september 2021

An exception to this retroactive effective date applies to written binding contracts in effect as of September 12 2021 in the case of the 50 limit on the gain exclusion for QSBS or September 13 2021 in the case of the increase in the long-term capital gains rate provided that the contract is not modified thereafter in any material respect. Biden plans to increase this to 434 percent for households earning more than 1 million.

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year.

. In some cases you add the 38 Obamacare tax but at worst your total tax bill is 238. 1 Congress already passed one budget reconciliation bill in 2021 The American Rescue Plan which was for the fiscal year ending 2021. Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan.

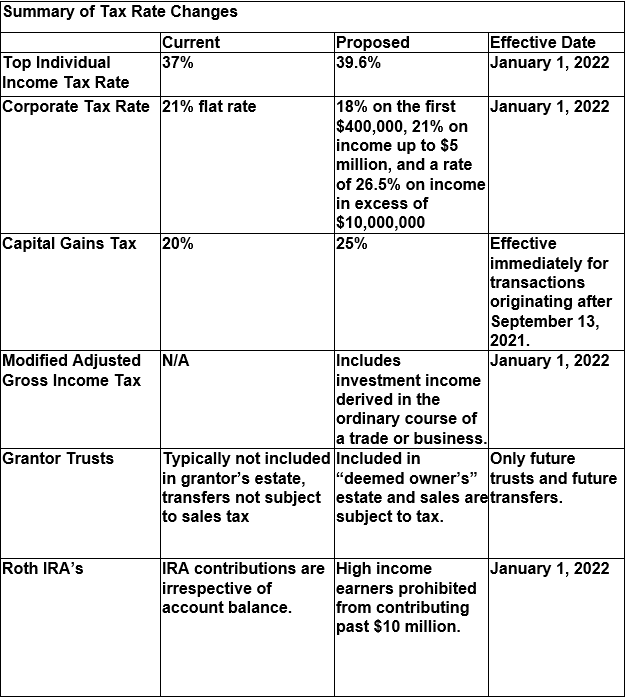

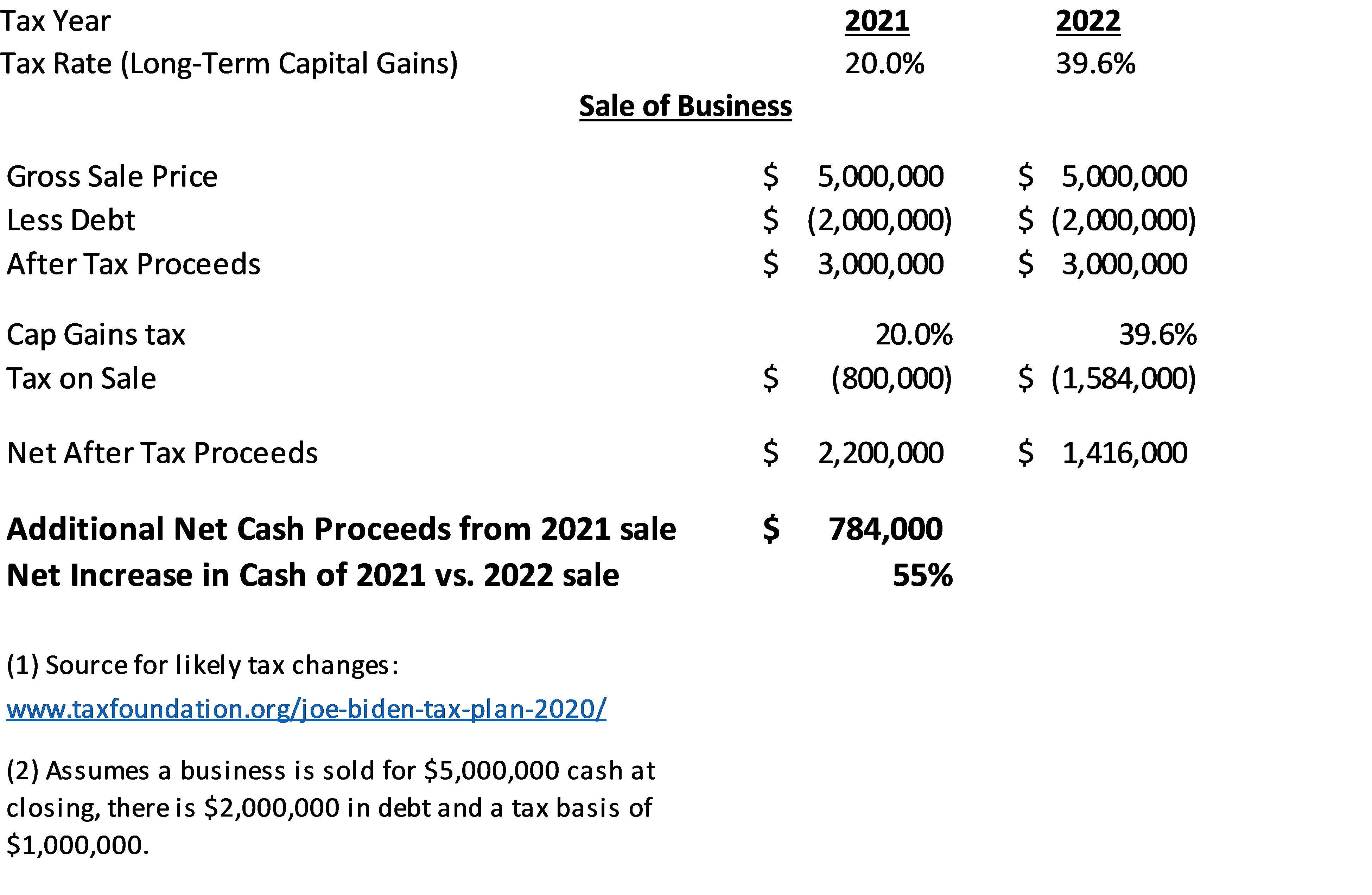

The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38 Medicare surtax. The current maximum 20 rate will continue to apply to gains earned prior to September 13 2021 as well as any gains that originate from transactions entered into under binding written contracts prior to September 13 2021. In some cases you add the 38 Obamacare tax but at worst your total tax bill is 238.

The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451 in some cases add the 38 Obamacare tax. An exception to this retroactive effective date applies to written binding contracts in effect as of September 12 2021 in the case of the 50 limit on the gain exclusion for QSBS or September 13 2021 in the case of the. Capital gains tax property exemption tool This link opens in a new window.

12 Oct 2021 QC 18138. FAQ on capital gains outlook and effective date. By SBE Council at 30 September 2021 1056 am Higher Capital Gains Taxes Retroactive Increases at Death Most Harmful For Immediate Release.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals regular income tax rate completely eliminating the tax benefits of capital gains. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income.

September 4 2021 at 323 pm71036. Some of these provisions if enacted would have effective dates retroactive to the date the legislation was proposed September 13 2021. Among individual taxpayers in 2021 those making 40400 or less without paying capital gains tax wont have to pay capital gains tax in that case.

In addition the proposal specifies the change will take effect retroactive to September disallowing investors from selling their position before the. The capital gains tax increase as of September 13 2021 there are no retroactive taxes in the proposal affecting individuals estates or trusts. A new report released by the Small Business Entrepreneurship Council SBE Council today ranks select tax increases proposed by the Biden Administration from least economically.

In late May specific details of President Bidens tax proposals were released including. The presidents proposed 434 capital gain rate is supposed to hit only those earning 1m or more but if you bought a house 30 years ago that is now worth over 1m you. If you sold or are going to sell or otherwise dispose of property that you own this tool helps you work out what portion of your capital gain is exempt from CGT.

But additionally he wants this implemented retrospectively to April 2021. I read that it would be unconstitutional and struck down in the courts if Biden attempts to try to make his still-unpassed elimination of long-term capital gains rates retroactive for 2021. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income.

IR-2021-118 May 24 2021 The Internal Revenue Service today announced that the 2021 Virtual IRS Nationwide Tax Forum will be held over five weeks starting July 20 with a series of live-streamed webinars every Tuesday Wednesday and Thursday. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238.

Kaye Thomas Moderator Congress has never enacted a tax law that is retroactive in the way you indicate so we dont have a definitive. This would prevent wealthy people from quickly selling off their assets before the end of the year to avoid the hike. A true tax hike.

If you live in a state that taxes capital gains youre going to see an additional tax on top of it leaving certain individuals with marginal capital gains rates past 40. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April 2021. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income.

The higher rate will be effective for qualified dividends paid or sales that occur on or after September 13 2021 when the proposal was released. Bidens Proposed Retroactive Capital Gains Tax Increase. Zad Siadatan talks about current capital gains tax and what might change during 2021.

A retroactive to April or May of 2021 increase in long-term capital gains rates for taxpayers with adjusted gross income above 1 million. On The Retroactive Capital Gains Tax Hike. The treatment of gifts at death as sales that require capital gains tax to be paid on amounts over 1 million.

Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up. Are retroactive tax increases constitutional or even fair.

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Retroactive capital gains tax september 2021. This plan was made to be retroactive in.

On average individual taxpayers in 2021 wont have to pay capital gains tax if their taxable income is below 40400. Are retroactive tax increases constitutional or even fair. A Retroactive Capital Gains Tax Increase.

Date Published 08072021.

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Time Is Running Out Close Before December 31st 2021 For Potentially Significant Tax Savings Newbridge Group

What Can The Wealthy Do About Biden S Proposed Tax Increases

Biden S Proposed Retroactive Capital Gains Tax Increase

Tax Planning Through Uncertainty To Sell Or Not To Sell Bkd

Crystal Ball Gazing To The Past Article By Pearson Co

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Biden Tax Plan And 2020 Year End Planning Opportunities

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Crystal Ball Gazing To The Past Article By Pearson Co

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

If The Build Back Better Bill Does Pass In 2022 Will The Capital Gains Qsbs Changes Still Be Retroactive To 2021 R Fatfire

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra